There’s simply no credit score check to end upward being capable to utilize plus you’ll enjoy several associated with the particular cheapest costs associated with any kind of cash advance software on this particular cash borrowing app checklist. Your Own advance will become automatically repaid whenever an individual obtain your own next paycheck, yet when you happen to want some additional period, Sawzag won’t cost you a late charge. As Soon As your own advance offers recently been repaid, you’re free to end upward being able to borrow once again. Funds App is a flexible participant within the lending industry, giving a blend associated with banking features and micro-loans below one roof. It stands like a hassle-free alternative to traditional borrowing apps along with their special functions plus loan offer. Membership And Enrollment in inclusion to limit boosts strongly rely about individual monetary situations, borrowing historical past, plus well-timed repayment skills.

How Does Borrowing From Funds Application Impact The Credit Score?

Funds Application evaluates membership and enrollment case-by-case, getting into accounts different aspects associated with your current bank account and economic history. Facilitating transaction via a protected program like Funds Application is usually a positive, too. “When it’s between this plus heading to get a salary advance from a predatory location, this is a much better option,” he states. He Or She adds that typically the flat five per cent charge is low for a individual loan. Typically The choices to be in a position to pay again your mortgage earlier within total or preschedule auto repayments usually are beneficial techniques to lessen the chances regarding being late, as well.

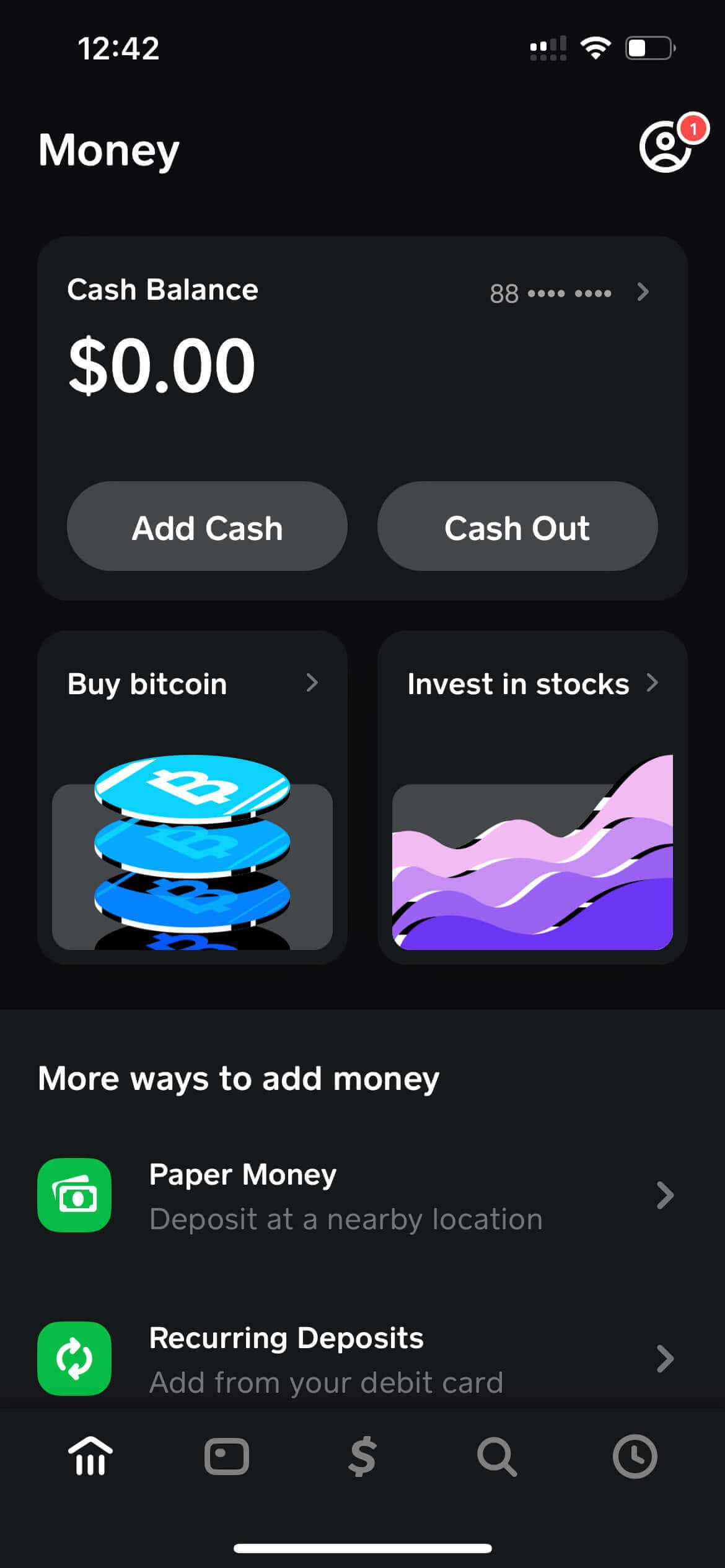

Funds App Financial Loan Software

This Particular site plus CardRatings may possibly receive a commission coming from cards issuers. Views, reviews, analyses & recommendations are usually the particular author’s by yourself and have got not really already been examined, recommended or authorized simply by any of these entities. Borrowing cash is in no way enjoyment, especially when you find yourself panicking. We hope this specific article on just how to end upward being in a position to borrow money from Money Software provides assisted you to observe that will you may borrow cash when you’re eager.

- Therefore proceed ahead plus unlock Money Software Borrow in order to get the particular money a person need today.

- Cash Application Borrow will be a feature of which enables entitled users to consider out small loans directly by indicates of the particular application.

- It may end up being a possibility of which the particular Funds app might possess several bugs or technological glitches leading to the particular borrow characteristic to not necessarily work.

- Nevertheless, when a person possess empowered this particular alternative and would like in order to use it, you ought to understand exactly how to become capable to carry out it correctly.

- Cash Application Borrow is usually not at present available within all declares in inclusion to they will tend not to acknowledge apps.

Money Application is usually a person-to-person payment application that permits people in order to send out in addition to get funds to become capable to plus from one one more very easily. The software was released inside 2013 simply by Prevent, Incorporation. (formerly Square, Incorporation.) to end up being in a position to be competitive together with additional transaction applications such as Venmo in inclusion to PayPal and was at first referred to as Rectangular Money. Simply By subsequent these sorts of methods, an individual could very easily access Funds App Borrow when you satisfy the particular membership needs. Funds Application gives loans in between $20 plus $200, nevertheless not all users usually are eligible for the particular same loans.

Apple M1 Chip Vs Intel: The A Couple Of Effective Processors In Contrast

Whilst it can become frustrating to wait around for it to end up being in a position to acquire even more extensively accessible, a person may use our own suggestions to be eligible regarding Borrow quicker or attempt a single associated with the alternative methods to be in a position to obtain money. You’ll get a tiny amount—somewhere among $20 and $850—for a set phrase associated with 4 days. The Particular least difficult method to get cash from Money Application is simply by seeking your own buddies to become capable to send out an individual a few. Therefore typically the option can seem and and then fade randomly—without virtually any justification supplied. Payday loans demand through $10 in buy to $30 for each every single $100 an individual get away.

Just How To End Upward Being In A Position To Get Away A Mortgage With Funds App: An Expert Weighs Advantages Plus Drawbacks

Yet it’s essential in purchase to understand how it performs and just what in buy to view out with consider to. An Individual can pay off your current mortgage by indicates of the particular cash a person obtain within the Funds App (10% regarding each deposit). Additionally, an individual may also create obligations personally each few days or pay inside total at when. You’ll require to pay applying typically the money you down payment inside the particular Cash Application. Furthermore, Money Software will take typically the sum through your own Funds Software stability automatically if you don’t pay by simply typically the deadline. Studying exactly how to become capable to borrow money upon Money Application is usually great when you would like to create small, immediate loans.

The Particular Greatest Publications Regarding Getting Out There Associated With Personal Debt Inside 2025: Are You Ready?

(You’ll even make cash for just finishing your current profile!) A Person could generate funds today in inclusion to pull away your own income by means of PayPal as soon as you’ve attained $10. A Person may generate above $100/month together with KashKick – in addition to a person don’t require to spend a dime or consider out your own credit credit card to become in a position to perform it. The speedy acceptance periods plus versatile borrowing limits regarding many funds advance apps may assist reduce several of the pressure.

- Implementing regarding a funds advance together with Cash App Credit Score Cards will be basic in add-on to straightforward.

- Your eligibility is usually centered upon your own bank account activity and location, so the borrow option may not necessarily be available in order to an individual at this moment.

- Eligibility plus limit increases highly depend about personal financial scenarios, borrowing historical past, in add-on to regular repayment abilities.

- If you’re continue to having trouble deciding if this is the correct choice for you, weigh the pros and cons prior to a person create a move.

- Borrowing cash through Cash Application will be straightforward, but making use of it sensibly needs strategy.

Repayment Framework And Attention Prices

When an individual borrow funds from Money Software, a person will have to become in a position to pay a great extra flat payment associated with 5%. For example, borrowing $200 means a person need to pay off typically the loan together with an additional $10. Simply By understanding these varieties of repayment phrases, it will become less difficult to handle repayments in inclusion to stay organized all through typically the process. This Specific helps make sure that will borrowers have got greater manage above their finances whilst applying cash programs credit score cards regarding a funds advance. Today let’s take a closer appearance at safety and fraud safety steps offered by Funds Software Credit Playing Cards.